By Jun Nucum

HAYWARD, California – One great achievement in the fulfilment of the American Dream especially among immigrants is to have a steady roof in their heads either by owning their own homes or affording the cost of rent no matter how big or small your abode is.

In the San Francisco Bay Area, this goal is considered more within reach in the east bay City of Hayward that is considered the Heart of the Bay Area Hayward and with it the monicker one of also the last areas in the Bay Area where housing and rent are still relatively affordable compared to some of our neighboring cities.

But in recent years challenges to preserving home ownership have emerged and to enlighten more on this, American Community Media together with Housing and Economic Rights Advocates conducted a Hayward–East Bay ethnic media briefing: Preserving Home Ownership in Hayward: Heart of the Bay New Challenges and What Families Can Do at Hayward Public Library.

Among these challenges are discovering the hidden risks — deed theft, predatory condo HOA practices, inheritance disputes, and language barriers — that can make keeping their home nearly impossible.

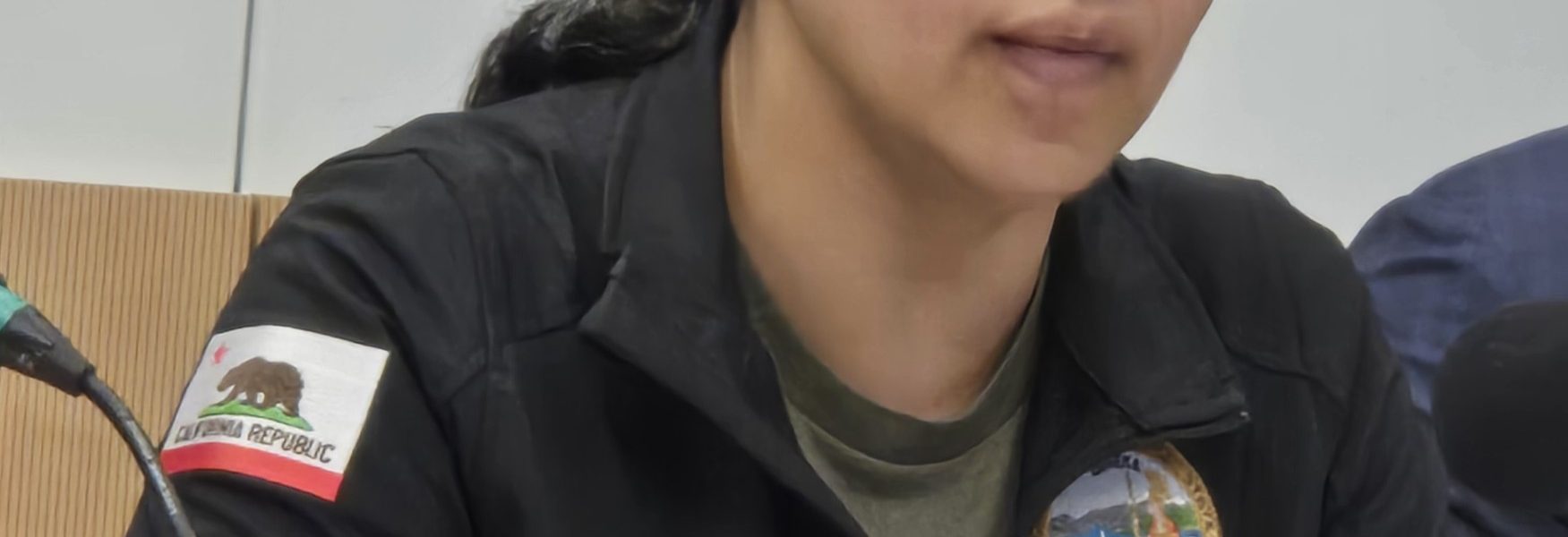

In the panel were California District 10 Senator Aisha Wahab, Chief Executive Officer, East Bay Rental Housing Association Derek Barnes, Executive Director, A-1 Community Housing Services Nancy Rivera, Housing Manager of City of Hayward Christina Morales Executive Director of Housing and Economic Rights Advocates (HERA) Maeve Elise Brown, HERA Senior Attorney Gina Di Giusto, and Housing Program Manager, ASIAN, Inc. Kary Hua.

Among the many issues discussed, one that stood out were that of eviction of renters that included seniors, veterans, disabled, and immigrant population.

Senator Wahab, former Hayward City Council member before being elected to the California State Senate, herself still a renter and undeniably the only one of the forty state senators representing forty million Californians, shared that during the Great Recession her family lost their home in foreclosure making the issue of the housing crisis a personal issue for her.

“This is a story of millions of Americans across the nation and the reality is that even when you get a degree, a good-paying job, and much more in the Bay Area, if you make six figures, $100,000 a year, we were still considered low income. We have that concern especially since the federal poverty level definition does not include housing in that algorithm,” informed Wahab. “If they were to include housing, nearly all of us would be considered under federal poverty line. And in this district in Alameda County, nearly 25% of the population live below the poverty line. Many of them renters, many of them came immigrant community members, and much more.”

Wahab revealed that she does not believe that the housing conversation at the state level and even nationally should be confined into the topic of production and supply although agreeing that there is a need to produce more housing.

“I will also highlight that as much as we have relaxed a lot of the regulations to develop more in 2023, we only developed a little over 100,000 units in the whole year, in the entire state. With that said, we are 2.5 million units in need for our actual population in the need of housing in a state of California. One million of those units needs to be for affordable housing,” Wahab reported. “I find housing to be a very difficult topic to talk about with my colleagues since I was the only renter in the entire state senate. It is hard to have those conversations with people who have not rented in the last 20 to 30 years as they are unaware of how renters are treated.”

Just the same, Wahab impressed that they had the very first social housing bill ever in the United States to be signed by our governor called Stable Affordable Housing Act in their very first year.

“This is to produce 1.4 million affordable units at moderate, low-income, and extremely low-income housing. This is being worked on right now by the administration. We have also pushed and the Governor just signed a stable housing is pro-housing which basically allows pro-housing local policies that prevent displacement. We have housing navigation centers that is among the different efforts throughout the state also that’s very anti-homeless,” Wahab added. “And I always have to remind people that’s our largest demographic that is growing amongst the homeless population is our seniors. Our seniors make up the largest demographic of the population of homelessness and they are also the largest demographic going back into the workforce who are on fixed incomes, have spent decades working. And so, those are some of the concerns that I have.”

Wahab also imparted that there was an increase in the renter’s tax credit, put in $300 million for a down payment assistance program, apart from the $500 million for the Homeless and Housing Assistance Program that a lot of the cities need to tackle some of the homeless issues and also limited Homeowners Association penalty fines to $100. I’m very proud of the work that the state legislature has done this year.”

For her part, HERA Executive Director Brown regard housing as fundamental “to our health, our happiness, our survival whether we are homeowners or tenants as the ability to have a safe affordable place to live is of unparalleled importance.

“We often forget about how homeownership fits into the ecosystem of housing and housing security in the United States especially in a high-cost area like the Bay Area, really lots of California at this point are very, very pricey. And so, part of what makes Hera unique is we work on debt and credit issues,” Brown explained.

“If you’re 65 years of age or older, regardless of gender, race or ethnicity, you own a home in the U.S. generally (but) we forget that because it’s so tight out there and one-third of that age group are massively price-burdened paying more than 34% of their income. Many are paying more than 50% of their income just for housing costs. We know tenants are also in the same boat,” rues Brown. “Older homeowners are more likely than ever now to still be paying on a mortgage, average mortgage person within the age 65 or usually older is about $265,000. The home is aging, along with our bodies. The home needs care, and we need to be able to pay for repairs, but where does that money come from when you’re barely holding on to being able to keep up with mortgage fees.”

Brown disclosed that foreclosure rates in California have gone up 20% year-over-year from 2024 to 2025 starting with the first required notice of default that has gone up 44% from last year to this year.

“This pattern looks very much to me like what we saw in the lead-up to the great foreclosure crisis. Some other complicated data points to perhaps set the table. All mortgage debt in the U.S. right now is sitting at about $13 trillion. Our non-mortgage debt — medical, student loans, auto loans, credit cards also greatly surpassed where we were at in 2008. And many other problems that we’re seeing right now are those that threaten the ability from the federal administration, that threaten people to survive,” Brown divulged. “Our goal to bring us together to talk about how we work. together to protect people and to help us understand our investment together in surviving here in Hayward chosen home.”