By Jun Nucum

SAN FRANCISCO — Cutting cost has been cited by billionaire Elon Musk- headed Department of Government Efficiency (DOGE) in slashing thousands of jobs (roughly 18%) by late May in the Internal Revenue Service (IRS).

Although the action to cut costs, that seem noble, experts warn that these staffing reductions could reduce government revenue by as much as $395 billion over the next decade. This comes at a time when the Republican-controlled Congress is pushing to extend the 2017 Trump-era tax cuts that could add $4 trillion to the national debt over ten years, with the majority of the benefits flowing to the wealthiest Americans.

These realities were discussed during the American Community Media media briefing Beyond April 15: How Taxation is Changing attended by a panel of leading tax experts who explored the far-reaching implications of these changes on government revenue, the economy, and taxpayers across the country.

The attendees included Deputy Director, NYU Tax Law Center; Former IRS Attorney Michael Kaercher, Professor of Law and Finance, Yale University. President, The Budget Lab Natasha Sarin, and Director of Policy Analysis, The Budget Lab Richard Prisinzano, and Senior Research Associate, Urban-Brookings Tax Policy Center Aravind Boddupalli.

Sarin worked at the Treasury Department for two years under the Biden administration primarily on issues of tax administration fully knowing why the IRS needs greater funding and needs to be able to modernize.

“Over the course of this tax filing season, the IRS is going to collect about 97% of the revenues that fund the federal government. That should be around $5 trillion this year. Of that $5 trillion that they’re going to collect, they’re going to miss out on a fair bit of revenue. They’re going to miss out on about $700 billion in taxes that are owed to the IRS and won’t be collected,” Sarin said. “And the reason they won’t be collected is because the vast majority of all of you are wage and salary earners, your taxes are withheld automatically. You still have to file your taxes. You have to pay. But there’s not really much for you to do vis-a-vis opportunities to evade or underpay your tax obligations.”

Sarin regards that type of work as hard that it requires a lot of manpower, literal people reading thousands of pages of corporate tax returns and trying to learn something about partnership law and figure out how to apply it all of which that takes both expertise and also a lot of time and resources from the agency to be able to do well.

Sarin rued that with the Trump’s administration’s pushes to decrease the size of the agency and decrease the investments in the agency, the literal first thing that has happened is that the IRS has gotten rid of 7,000 probationary employees either were recently hired to the IRS or who were recently promoted to different roles within the agency. She referred to them as disproportionately the people the IRS had managed to bring on to convince to join the agency to do this type of difficult high-end work.

Kaercher covered the impact of these moves to cut the IRS and how they relate to the expected moves to extend the tax cuts and recalled that the first Trump administration in 2017 passed a very large tax cut that was separated into two buckets and was around three and a half trillion dollars.

“It was a mix of corporate tax cuts and tax cuts for individuals. They significantly cut corporate taxes, including by reducing the corporate tax rate from 35% to 21%. That’s a huge difference,” Kaercher recalled. “On the individual side, they’ve provided tax cuts through the end of this year 2025 and the thinking there was you never really know if your Congress, if you can do more corporate tax cuts in the future but you’re very certain that you’re always going to be able to avoid an increase of taxes on individuals when those tax cuts were going to expire. So that was kind of the strategy.”

The key takeaway the Kaercher gets is that enormous tax cut going primarily to the rich paid for, if at all on the backs of low- and middle-income Americans while at the same time reduced tax compliance especially from larger businesses and corporations and reduced services from the tax from the IRS are likely.

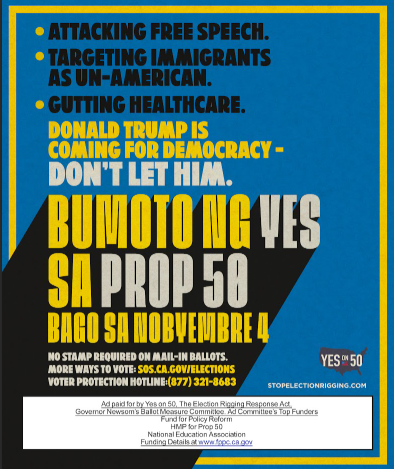

Boddupalli believes this data sharing agreement between the IRS and ICE undermines tax revenues and good governance, it breaks data privacy firewalls and reduces public trust and it is likely to worsen the well-being of many children and families across the US.

“The IRS’s job is to collect federal taxes and ensure everyone is complying with tax law but this agreement will effectively reduce how much federal taxes the agency collects because immigrants who are currently filing taxes may be intimidated or worse, deported. Estimates suggest that undocumented immigrants pay over $16 billion each year in federal income and payroll taxes. The nation’s fiscal outlook would be worse off because of the administration’s immigration actions to intimidate target or deport those who are complying with tax law,” Boddupalli estimated.

Prizinsano talked about the Budget Lab report on this issue of the IRS and the undocumented

“A lot of the individuals that are undocumented are only earning income through income a W2 so they’re having taxes withheld and then most don’t owe taxes at the end of the year and might get a refund,” Prizinsano repeated. “So currently there might be overpaying taxes because they’re afraid to file to get a refund that they might be subject to. The other piece is that the potential is that those people that are currently now potentially overpaying their taxes might rather have a cash situation with their job. They might renegotiate how they’re getting paid so that there’s no withholding.”

Prizinsano see a drop there because people would stop working in above table jobs and they might try to get paid under the table and for him that is a big issue.